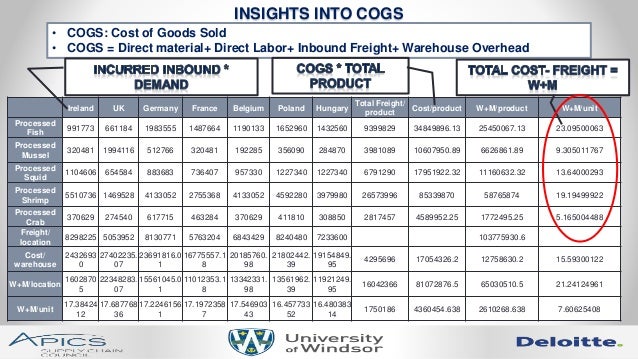

Cost of revenue: This is defined as the total cost of manufacturing and delivering a product or service to the customers.Operating expenses include the expenses that are not part of COGS and are not directly related to the production of goods and services such as expenses for payroll, marketing, research & development and insurance. However, they both are quite different in nature. Operating expenses: Similar to COGS operating expenses are as well the costs are expenditure of running a business.

The obtained results from the calculator may be used for gross profit margin calculation which is the indication of profitability and success of your business.ĬOGS is subtracted from the total revenue to determine the gross profit margin, let's take a look at what are the other expenses that are deducted from the gross profit and how they are different from COGS.

COGS INVENTORY MANUAL

The COGS calculator is as easy to use as it seems, it is online and saves you time and trouble of going through the manual calculations. On the basis of above inputs the calculator will provide you with the value of COGS.

How & Why to use COGS calculatorĪs discussed in the method above, you must enter the following three details in order to get the value of COGS from the calculator: The method of calculation is a lengthy process and may become tedious at times, but using an online calculator is ideal, let's take a look at how you can use the COGS calculator, designed by iCalculator to make things easier for you. You may calculate the ending inventory adding the beginning inventory value to the new purchases and then subtract the cost of goods.

COGS: Method of calculation and components explainedĬOGS is referred to as Cost of Sales, when calculating COGS only the direct costs (as explained above) should be considered. Let's explore the definition of COGS and its components. Like all other factors used in the above example, it also includes the cost of labor and any other cost that has a direct relation to the production of goods. All of these expenses are defined as the cost of goods sold.Ĭost of goods sold is the cost that occurs in production. If you are running a shoe manufacturing factory, you will have to buy the raw materials, use machinery to put the raw material together, use electricity to run the machines, and pay rent for the place where you perform all these operations. Determine Cost Of Goods Sold To Monitor Performance Of Your BusinessĮvery company incurs costs to generate revenue that results in profit.

0 kommentar(er)

0 kommentar(er)